Gig opportunities increase for skilled workers, including part-time retirees

By Stephen Miller, CEBS

February 6, 2020 - SHRM

Skilled workers and retirees are capitalizing on the tight U.S. labor market by turning to gig work. Often, their pay is better than traditional workers' in similar positions, a February report reveals.

Illuminating the Shadow Workforce: Insights into the Gig Workforce in Businesses from the ADP Research Institute, an affiliate of HR and payroll firm ADP, analyzed the 2019 payroll data of 18 million workers from 75,000 companies and 16,800 direct-survey responses from traditional employees and gig workers. Researchers noted that gig workers are grouped into two tax classifications and have distinct characteristics:

From 2010 to 2019, the share of gig workers in businesses increased by 15 percent, with both short-term W-2 and 1099-MISC workers contributing equally to this growth.

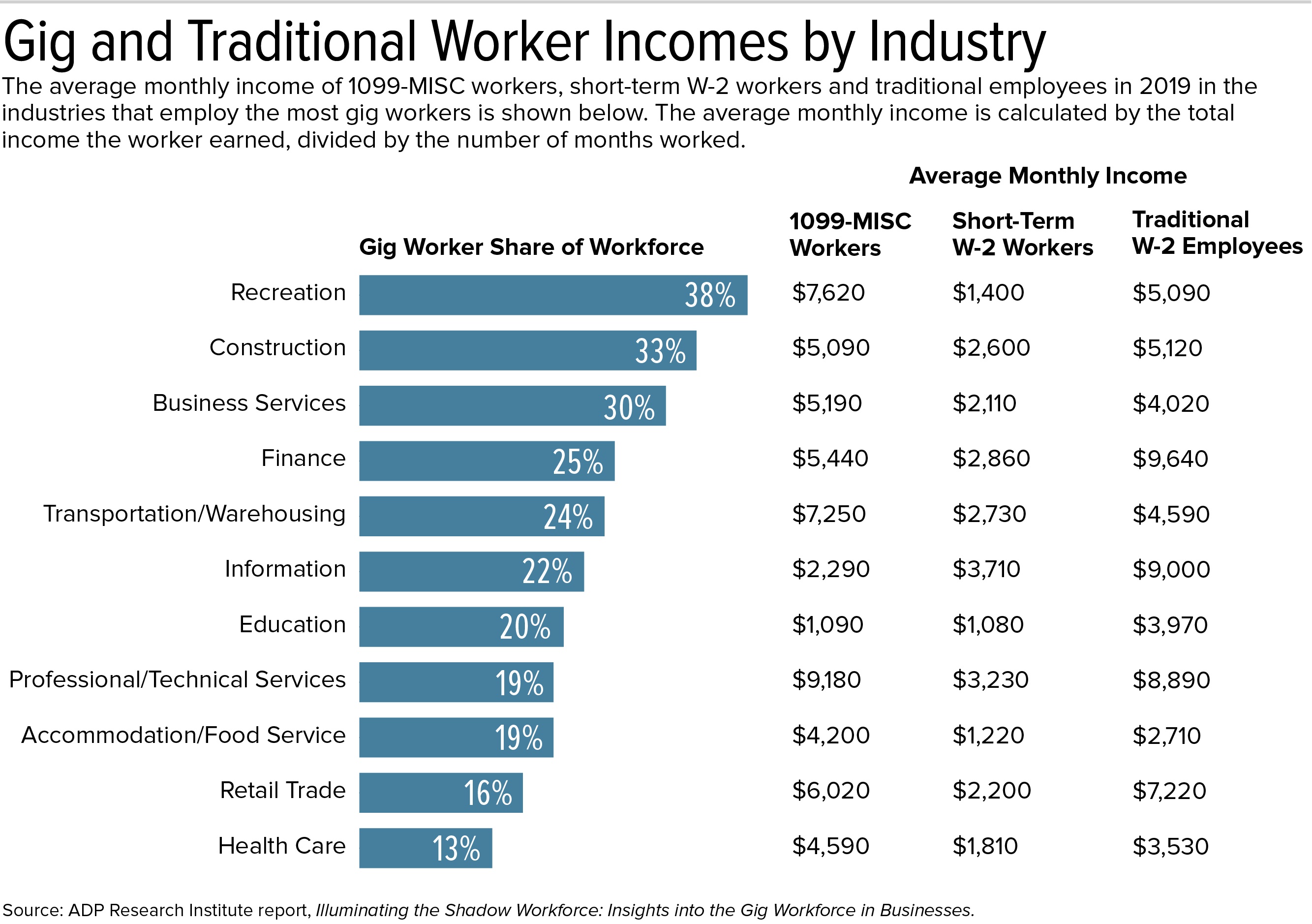

Almost 16 percent of the U.S. workforce comprises gig workers, and more so in certain sectors.

"The fight now is for skilled workers," said Ahu Yildirmaz, co-head of the ADP Research Institute. "There is a fundamental shift in the workforce as innovation continues to transform work, increasing the demand for skilled workers. To bridge the talent gap in today's tight labor market, many companies are hiring skilled [gig] workers at a premium" and often turning to those who are partly retired to meet their talent needs.

Every industry relies on gig workers, but some industries pay more than others, the ADP report showed. Recreation, construction and business services are the top three industries using gig workers, and in these industries, 1099-MISC workers are likely to earn more than traditional W‑2 employees doing similar work.

In particular, average monthly income for 1099-MISC workers can be considerably higher than that of traditional workers in industries where highly skilled professionals, such as attorneys, consultants or marketing experts, are engaged for special projects or tasks.

"From an income perspective, the 1099-MISC work is actually highly paid for

high-skilled jobs," Yildirmaz said.

In contrast, gig workers do not fare as well in the education and information sectors, which includes media businesses that attract many low-paid freelancers.

Information services is also an outlier in that traditional workers earn

five times more than what 1099‑MISC contractors earn. "In a booming economy,

companies are likely to pay well to keep the most highly skilled workers on

staff, especially if they are in a high-tech industry," according to the

report.

Depending on company circumstances, using skilled gig workers may help minimize payroll expenses by limiting employee overtime costs, especially if there is uncertainty about how long the worker will be needed, Yildirmaz noted.

In addition to wages and salaries, total rewards for traditional W-2

employees often include bonus pay, as well as employer-sponsored health care,

retirement plan contributions, and paid time off for vacation and personal and

sick leave.

| 1099-MISC Workers: Special Projects or Tasks | 1099-MISC Workers: Stop-Gap Labor | 1099-MISC Workers: Commission-Based | Short-Term W-2 Workers | |

|---|---|---|---|---|

| Employment Length | Until project

completion. |

Varies by business need,

such as busy periods and seasonal surges. |

Long-term potential at the

contractor's discretion. |

Seasonal or on-call, as

needed. |

| Pay |

Premium pay for lack of benefits and taxes or for specialized skill

set. Bidding process can drive pay up or down. |

Premium for lack of benefits and taxes and availability on short

notice. Potential for retainer bonus. |

Performance-based,

commission. |

Potential for premium pay

for availability on short notice. |

| Examples | Construction specialists to

support builder; specialized IT staff. |

Bartenders to support

catering service; pathologists for hospital lab. |

Commercial real estate

agents; remote salespeople. |

Holiday workers at retail

store; on-call workers for caterer. |

Source: ADP Research Institute report,

Illuminating the Shadow Workforce: Insights into the Gig Workforce in

Businesses.

More than 70 percent of 1099-MISC workers said they are working

independently by choice, not because they can't find a "traditional" job, ADP

found. "Most seem happy with gig work and place a premium on flexibility as a

driving motivation behind their decision, over financial security or benefits,"

Yildirmaz said.

It's a mistake to think that gig work is just for younger

workers, Yildirmaz added. While 20 percent of the overall traditional

workforce is over 55 years old, 30 percent of 1099-MISC workers are older than

55. These are "highly paid skilled workers who have retirement [income] and

benefits from their prior job and have come back into the workforce, or they

have benefits from their spouses," Yildirmaz noted. For these workers, gig work

"is part-time retirement."

Only 10 percent of 1099-MISC workers overall said they are doing gig work

because they can't find a permanent job, ADP reported. For younger gig workers,

however, the story is different: More than 50 percent of 1099-MISC workers under

age 35 said they would prefer to be full-time W‑2 employees.

|

The Center for Retirement Research at Boston College also recently reported that nontraditional jobs—defined as jobs without health and retirement benefits—are on the rise among older workers. This analysis used data from the University of Michigan's Health and Retirement Study, an ongoing survey of some 20,000 people throughout the U.S. The findings showed that just 26 percent of older U.S. residents held a traditional job with benefits consistently from ages 50 to 62. Workers with an earning spouse had less need to hold a job with benefits. |

More than 90 percent of gig workers have health insurance, ADP found. Among 1099‑MISC workers, less than one-third purchase their own individual insurance.

ADP interviews with employers found they believe that many 1099-MISC workers have made an economic decision with their spouse that one spouse works without benefits for higher pay and the other receives lower pay with benefits, resulting in a higher total income and health benefits for the household. Gig workers over age 65 have health insurance through Medicare.

Companies should incorporate gig workers into their workforce strategy,

Yildirmaz advised, and focus on those ages 55 and over in particular, "because

the skill sets that you'll need are the ones they have."